#wireless RF circuit

Explore tagged Tumblr posts

Text

https://www.futureelectronics.com/p/semiconductors--wireless-rf--receiver-ics/clrc63201t-0fe-112-nxp-2283646

NXP, CLRC63201T/0FE,112, Wireless & RF Receiver ICs

CLRC632 Series Multiple Protocol Contactless Reader IC (MIFARE/I-CODE1) -SOIC-32

#NXP#CLRC63201T/0FE#112#Wireless & RF Receiver ICs#HDMI circuit#wireless RF circuit#RF radio frequency#AM FM receiver#HDMI receiver IR circuit#Phase locked loop#what is a FM receiver circuit#Phase lock loops#wireless Bluetooth receiver

2 notes

·

View notes

Text

High performance circuit, High speed data transmission, module bluetooth

SP3077E Series 16 Mbps ±15 kV ESD Protected RS-485/RS-422 Transceiver-NSOIC-8

#MaxLinear#SP3077EEN-L#Wireless & RF#Transceiver ICs#RF Transceiver utilizes#band signals#wireless transmitter#Wifi#Bluetooth transceiver#usb wireless transceiver#High performance circuit#High speed data transmission#module

1 note

·

View note

Text

Best Partner for Wireless Modules: A Comprehensive Antenna Selection Guide

n the field of wireless communication, antenna selection is crucial. It not only affects the coverage range and transmission quality of signals but also directly relates to the overall performance of the system. Among various wireless modules, finding the right antenna can maximize their potential, ensuring stable and efficient data transmission.

When designing wireless transceiver devices for RF systems, antenna design and selection are essential components. A high-quality antenna system can ensure optimal communication distances. Typically, the size of antennas of the same type is proportional to the wavelength of the RF signal; as signal strength increases, the number of required antennas also grows.

Antennae can be categorized as internal or external based on their installation location. Internal antennas are installed within the device, while external antennas are mounted outside.

In situations where space is limited or there are multiple frequency bands, antenna design becomes more complex. External antennas are usually standard products, allowing users to simply select the required frequency band without needing additional tuning, making them convenient and easy to use.

What are the main types of antennas?

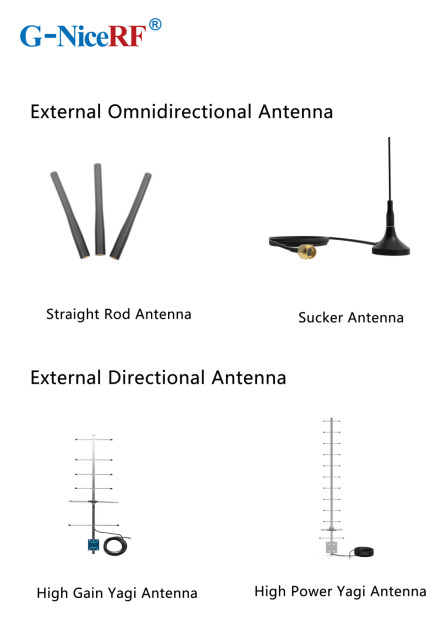

External Antennas: These antennas can be classified into omnidirectional antennas and directional antennas based on the radiation pattern.

Internal Antennas: These antennas refer to antennas that can be placed inside devices.

Omnidirectional Antennas: These antennas radiate signals uniformly in the horizontal plane, making them suitable for applications that require 360-degree coverage, such as home Wi-Fi routers and mobile devices.

Directional Antennas: These antennas have a high emission and reception strength in one or more specific directions, while the strength is minimal or zero in others. Directional antennas are primarily used to enhance signal strength and improve interference resistance.

PCB Antennas: These antennas are directly printed on the circuit board and are suitable for devices with limited space, commonly used in small wireless modules and IoT devices.

FPC Antennas: FPC antennas are flexible printed circuit antennas that are lightweight, efficient, and easy to integrate.

Concealed Antennas: Designed for aesthetic purposes, concealed antennas can be hidden within devices or disguised as other objects, making them suitable for applications where appearance is important without compromising signal quality.

Antenna Selection Guide

When selecting the appropriate antenna for a communication module, it's essential to first determine whether to use an internal or external antenna based on the module's structure.

External Antennas: These antennas offer high gain, are less affected by the environment, and can save development time, but they may take up space and impact the product's aesthetics.

Internal Antennas: These have relatively high gain and are installed within the device, maintaining a clean and appealing exterior.

Sucker Antennas: These provide high gain and are easy to install and secure.

Copper Rod Sucker Antennas: Made from large-diameter pure copper radiators, these are highly efficient with a wide bandwidth.

Rubber Rod Antennas: Offer moderate gain at a low cost.

Fiberglass Antennas: Suitable for harsh environments and ideal for long-distance signal

External Directional Antennas

Typically used in environments with long communication distances, small signal coverage areas, and high target density.

Panel Antennas have high efficiency, are compact, and easy to install, while considering the impact of gain and radiation area Yagi Antennas offer very high gain, are slightly larger, and have strong directionality, making them suitable for long-distance signal transmission; however, attention must be paid to the antenna's orientation during use

Internal Antenna Selection

Most internal antennas are affected by environmental factors and may require custom design or impedance matching

Spring Antennas are cost-effective but have low gain and narrow bandwidth, often requiring tuning for good matching when installed Ceramic Patch Antennas occupy minimal space and perform well, but have a narrow bandwidth

For details, please click:https://www.nicerf.com/products/ Or click:https://nicerf.en.alibaba.com/productlist.html?spm=a2700.shop_index.88.4.1fec2b006JKUsd For consultation, please contact NiceRF (Email: [email protected]).

2 notes

·

View notes

Text

How Do Power, Motor & Robotics Development Tools Drive Innovation in Automation?

Introduction to Modern Development Ecosystems

As the era of intelligent machines, automation, and smart manufacturing continues to advance, Power, Motor & Robotics Development Tools have emerged as essential components in transforming ideas into functioning prototypes and commercial solutions. These tools serve as the backbone for developing precise and reliable control systems used in a wide variety of sectors—from industrial robotics to electric mobility.

With the increasing integration of microcontrollers, sensors, thermal management components, and electronic controllers, development tools offer a modular and practical approach to building sophisticated electronic and electromechanical systems.

What Are Power, Motor & Robotics Development Tools?

Power, Motor & Robotics Development Tools consist of hardware kits, interface boards, and control modules designed to help developers and engineers test, prototype, and deploy automated systems with precision and speed. These tools make it possible to manage current, voltage, mechanical motion, and real-time decision-making in a structured and scalable manner.

By combining essential components such as capacitors, fuses, grips, cables, connectors, and switches, these kits simplify complex engineering challenges, allowing smooth integration with controllers, microprocessors, and sensors.

Exploring the Primary Toolsets in the Field

Power Management Development Tools

Efficient energy management is crucial for ensuring stability and performance in any robotic or motor-driven system.

Development boards supporting AC/DC and DC/DC conversion

Voltage regulators and surge protection circuits for safe energy flow

Thermal sensors and oils to maintain system temperature

Battery management ICs to control charge-discharge cycles

High-efficiency transformers and current monitors

Motor Control Development Tools

Motor control kits are built to manage torque, direction, and speed across a range of motor types.

H-bridge motor drivers for bidirectional motor control

Stepper motor controllers with high-precision movement

Brushless DC motor driver modules with thermal protection

Feedback systems using encoders and optical sensors

PWM-based modules for real-time torque adjustment

Robotics Development Tools

Robotics kits merge both mechanical and electronic domains to simulate and deploy automation.

Preassembled robotic arm platforms with programmable joints

Sensor integration boards for object detection, motion sensing, and environmental monitoring

Wireless modules for IoT connectivity using BLE, Wi-Fi, or RF

Microcontroller development platforms for logic execution

Mounting hardware and cable grips for secure installations

Benefits of Using Professional Development Tools

Advanced development kits offer more than just experimentation—they serve as stepping stones to commercial production. These tools minimize development time and maximize productivity.

Enhance system performance with modular plug-and-play designs

Enable easy integration with laptops, diagnostic tools, and controllers

Reduce design errors through pre-tested circuitry and embedded protection

Facilitate rapid software and firmware updates with compatible microcontrollers

Support debugging with LED indicators, thermal pads, and status feedback

Key Applications Across Industries

The adaptability of Power, Motor & Robotics Development Tools makes them suitable for countless industries and applications where intelligent movement and power efficiency are essential.

Industrial robotics and pick-and-place systems for manufacturing automation

Smart agriculture solutions including automated irrigation and drone control

Automotive design for electric vehicle propulsion and battery systems

Aerospace applications for lightweight, compact control mechanisms

Educational platforms promoting STEM learning with hands-on robotics kits

Essential Components that Enhance Development Kits

While the kits come equipped with core tools, several other components are often required to expand capabilities or tailor the kits to specific use cases.

Sensors: From temperature and light to current and magnetic field detection

Connectors and plugs: For flexible integration of external modules

Switches and contactors: For manual or automatic control

Thermal pads and heatsinks: For preventing overheating during operation

Fuses and circuit protection devices: For safeguarding sensitive electronics

LED displays and character LCD modules: For real-time data visualization

How to Choose the Right Tool for Your Project

With a vast array of kits and tools on the market, selecting the right one depends on your application and environment.

Identify whether your project focuses more on power management, motor control, or full robotic systems

Consider compatibility with popular development environments such as Arduino, STM32, or Raspberry Pi

Check the current and voltage ratings to match your load and motor specifications

Evaluate add-on support for wireless communication and real-time data processing

Ensure the tool includes comprehensive documentation and driver libraries for smooth integration

Why Development Tools Are Crucial for Innovation

At the heart of every advanced automation solution is a well-structured foundation built with accurate control and reliable hardware. Development tools help bridge the gap between conceptualization and realization, giving engineers and makers the freedom to innovate and iterate.

Encourage experimentation with minimal risk

Shorten product development cycles significantly

Simplify complex circuit designs through preconfigured modules

Offer scalability for both low-power and high-power applications

Future Scope and Emerging Trends

The future of development tools is headed toward more AI-integrated, real-time adaptive systems capable of learning and adjusting to their environment. Tools that support machine vision, edge computing, and predictive analytics are gaining traction.

AI-powered motion control for robotics

Integration with cloud platforms for remote diagnostics

Advanced motor drivers with feedback-based optimization

Miniaturized power modules for wearable and mobile robotics

Conclusion: Is It Time to Upgrade Your Engineering Toolkit?

If you're aiming to build smarter, faster, and more energy-efficient systems, Power, Motor & Robotics Development Tools are not optional—they’re essential. These kits support you from idea to implementation, offering the flexibility and performance needed in modern-day innovation.

Whether you're developing a prototype for a high-speed robotic arm or integrating power regulation into a smart grid solution, the right development tools empower you to transform challenges into achievements. Take the leap into next-gen automation and electronics by investing in the tools that make engineering smarter, safer, and more efficient.

#Power Motor & Robotics Development Tools#electronic components#technology#electricalparts#halltronics

0 notes

Text

RF Absorbers in USA | Canada - DMCRF

When it comes to controlling unwanted radio frequency (RF) energy, choosing high-quality RF absorbers is essential for reliable performance in various applications. At dmcrf.com, we provide a wide range of RF absorbers in Canada and the USA, ensuring that engineers, researchers, and manufacturers get the right solutions for their specific needs. Whether you are designing an anechoic chamber, shielding sensitive equipment, or managing electromagnetic interference (EMI), the right RF absorber can make a significant difference.

Why RF Absorbers Matter

RF absorbers are materials engineered to absorb electromagnetic waves instead of reflecting them. This helps to minimize stray signals, reduce noise, and improve the accuracy of RF testing environments. They are widely used in industries such as aerospace, defense, telecommunications, and electronics manufacturing. From foam absorbers and pyramidal panels to custom solutions, these materials ensure your equipment operates at peak performance with minimal interference.

Quality RF Absorbers in Canada and the USA

At dmcrf.com, we take pride in supplying high-performance RF absorbers in Canada and across the USA. Our product range is designed to meet the demanding standards of modern RF and microwave applications. Customers trust our expertise and our commitment to delivering solutions that are both effective and durable.

Applications for RF Absorbers

Anechoic Chambers: Used to create controlled, reflection-free environments for testing antennas, radars, and wireless devices.

EMI Shielding: Helps in isolating sensitive electronic circuits from unwanted RF interference.

Military and Aerospace: Essential for stealth technology, radar cross-section reduction, and secure communication systems.

Research and Development: Used in laboratories and academic institutions to conduct accurate RF measurements.

Why Choose DMC RF?

dmcrf.com stands out for its customer-focused approach and technically advanced solutions. We help you choose the right absorbers based on frequency range, material type, and installation requirements. With quick shipping across Canada and the USA, you can count on us for both standard and custom RF absorber products.

If you are looking for reliable RF absorbers in USA, look at dmcrf.com to explore our product range. Our technical experts are ready to assist you with any queries and help you find the ideal solution for your project. Call: +1(613) 915 5533 Visit Us: https://www.dmcrf.com/rf-and-microwave-absorbers/

0 notes

Text

RF Absorbers in USA | Canada - DMCRF

When it comes to controlling unwanted radio frequency (RF) energy, choosing high-quality RF absorbers is essential for reliable performance in various applications. At dmcrf.com, we provide a wide range of RF absorbers in Canada and the USA, ensuring that engineers, researchers, and manufacturers get the right solutions for their specific needs. Whether you are designing an anechoic chamber, shielding sensitive equipment, or managing electromagnetic interference (EMI), the right RF absorber can make a significant difference.

Why RF Absorbers Matter

RF absorbers are materials engineered to absorb electromagnetic waves instead of reflecting them. This helps to minimize stray signals, reduce noise, and improve the accuracy of RF testing environments. They are widely used in industries such as aerospace, defense, telecommunications, and electronics manufacturing. From foam absorbers and pyramidal panels to custom solutions, these materials ensure your equipment operates at peak performance with minimal interference.

Quality RF Absorbers in Canada and the USA

At dmcrf.com, we take pride in supplying high-performance RF absorbers in Canada and across the USA. Our product range is designed to meet the demanding standards of modern RF and microwave applications. Customers trust our expertise and our commitment to delivering solutions that are both effective and durable.

Applications for RF Absorbers

Anechoic Chambers: Used to create controlled, reflection-free environments for testing antennas, radars, and wireless devices.

EMI Shielding: Helps in isolating sensitive electronic circuits from unwanted RF interference.

Military and Aerospace: Essential for stealth technology, radar cross-section reduction, and secure communication systems.

Research and Development: Used in laboratories and academic institutions to conduct accurate RF measurements. Call: +1(613) 915 5533 Visit Us: https://www.dmcrf.com/rf-and-microwave-absorbers/

0 notes

Text

ASC-i's Advanced RF Test Capabilities: Ensuring Peak Performance for Your RF PCB Designs

As an industry-leading RF PCB manufacturer, ASC-i is dedicated to providing high-performance, high-quality solutions for a wide range of applications, including wireless communication, automotive radar, medical devices, and IoT systems. When it comes to RF PCBs, ensuring the reliability and functionality of the circuits is paramount. With our advanced RF test capabilities, we ensure that every PCB we produce meets the rigorous demands of the RF industry, delivering optimal performance across all environments and conditions.

The Importance of RF Testing for High-Quality PCB Manufacturing

Radio Frequency (RF) signals are critical for modern communication systems, and even the smallest flaw in the design or manufacturing of an RF PCB can lead to signal loss, interference, or even complete failure. This is why thorough RF testing is essential at every stage of PCB production. At ASC-i, we recognize that precise testing ensures the signal integrity, performance, and durability of the final product. Our RF testing services are designed to identify potential issues early, ensuring that your designs perform at their best before they are integrated into end-use products.

As a trusted RF PCB manufacturer, ASC-i provides comprehensive testing solutions that guarantee each RF PCB we create meets the highest industry standards. Whether you're developing high-frequency communication systems or specialized RF devices, we have the expertise and tools to ensure your products meet exacting specifications.

ASC-i’s Advanced RF Test Capabilities

Our RF test capabilities are built to cover every essential aspect of RF performance, ensuring that your RF PCBs operate reliably and efficiently. Our testing process focuses on key parameters such as signal integrity, impedance matching, thermal stability, power handling, and electromagnetic compatibility. Here’s an overview of our comprehensive RF testing services:

S-Parameter Testing: S-parameters, or scattering parameters, measure the reflection and transmission characteristics of RF circuits. By using high-precision network analyzers, ASC-i tests the insertion loss, return loss, and signal integrity of the RF PCB. This allows us to ensure that the board exhibits minimal signal degradation and high performance under real-world conditions.

Impedance Matching Tests: One of the most critical aspects of RF circuit performance is impedance matching. Proper impedance ensures that the signal is transmitted without reflection or loss. We perform detailed impedance testing across PCB traces, vias, and components to ensure that the impedance is optimized, guaranteeing smooth and efficient signal transmission.

RF Power Handling Testing: RF PCBs often need to handle high power levels, especially in demanding applications like wireless communication, radar, and broadcast systems. We test the power-handling capacity of your PCB to ensure that it can withstand high power inputs without compromising performance or causing thermal issues.

Thermal Performance Testing: RF circuits generate heat, and without proper heat management, thermal buildup can lead to degradation in signal quality or even failure of components. ASC-i conducts comprehensive thermal tests to evaluate how effectively the RF PCB dissipates heat and performs under varying temperature conditions.

Environmental and Aging Tests: To simulate the real-world conditions your RF PCB will face over time, we perform aging and environmental tests that assess how the board handles temperature fluctuations, humidity, vibration, and other environmental factors. This ensures that the RF PCB is durable and can withstand long-term use.

Electromagnetic Interference (EMI) Testing: EMI can significantly disrupt the performance of RF circuits. Our EMI testing ensures that your PCB meets electromagnetic compatibility standards, minimizing the risk of interference with nearby components and ensuring that the device operates smoothly in its intended environment.

Custom RF Testing Solutions for Every Need

At ASC-i, we know that each project is unique. Whether you’re designing a wireless communication system, automotive radar unit, or medical RF device, our team of engineers is ready to customize our testing solutions to meet the specific needs of your design. We work closely with you to understand the requirements of your project and develop a tailored testing plan that addresses all relevant performance factors.

By providing tailored testing services, we ensure that your RF PCBs will meet the precise criteria for your application, ensuring flawless performance across different environments and use cases.

Why Choose ASC-i as Your RF PCB Manufacturer?

Expertise and Experience: With years of experience in designing and manufacturing RF PCBs, ASC-i brings invaluable expertise to every project. Our engineers are well-versed in RF design principles and testing methods, allowing us to deliver high-quality, high-performance RF PCBs for a wide range of applications.

State-of-the-Art Testing Equipment: ASC-i uses the latest testing technologies and equipment to ensure the accuracy and precision of our testing processes. Our RF testing labs are equipped with advanced tools such as network analyzers, spectrum analyzers, thermal chambers, and more to ensure that each PCB is tested to the highest standards.

Comprehensive Testing Services: From signal integrity to thermal and environmental testing, ASC-i provides a full spectrum of RF test services. Our rigorous testing process ensures that each PCB performs optimally in its intended application, providing a reliable solution for every project.

Customization: Every RF PCB design has unique needs. ASC-i offers customized RF testing solutions that can be tailored to meet the specific parameters of your design. We take a collaborative approach to understand the requirements of your project and offer flexible testing services to address your needs.

Quality Assurance: At ASC-i, we prioritize quality in every stage of the manufacturing and testing process. Our robust testing procedures help identify and address any potential issues early, ensuring that your RF PCB meets the highest standards of reliability, durability, and performance.

Timely and Cost-Effective Solutions: We understand the importance of meeting deadlines in the fast-paced world of electronics. ASC-i offers quick turnaround times without compromising quality, allowing you to meet your project timelines while keeping costs under control. Our streamlined processes ensure that you receive competitive pricing for top-tier testing and manufacturing services.

Conclusion

ASC-i is your trusted partner for RF PCB manufacturing and testing services. Our advanced RF test capabilities, coupled with our expertise in RF design and production, allow us to deliver high-quality RF PCBs that perform reliably in the most demanding applications. Whether you’re developing a new wireless communication device, automotive radar system, or medical equipment, ASC-i’s comprehensive RF testing ensures that your PCB will meet the highest standards of performance, reliability, and durability.

Partner with ASC-i today and experience the difference our advanced RF testing capabilities can make for your RF PCB designs. We’re here to help you achieve success by delivering top-quality, high-performance solutions that meet the challenges of today’s technology-driven world. Contact us to learn more about our RF PCB manufacturing and testing services.

0 notes

Text

Global WiFi and Bluetooth RF Antenna Market: Growth Drivers, Technological Advancements, and Forecast 2025–2032

MARKET INSIGHTS

The global WiFi Bluetooth Radio Frequency Antenna Market size was valued at US$ 4.86 billion in 2024 and is projected to reach US$ 8.42 billion by 2032, at a CAGR of 8.3% during the forecast period 2025-2032. The U.S. market accounted for 32% of global revenue in 2024, while China is expected to witness the fastest growth with an estimated 9.1% CAGR through 2032.

WiFi Bluetooth Radio Frequency Antennas are critical components that enable wireless communication across multiple frequency bands, including 2.4GHz and 5GHz for WiFi and 2.4GHz ISM band for Bluetooth. These antennas are categorized into internal (PCB, chip, flexible printed circuit) and external (directional, omnidirectional) types, each offering distinct advantages in terms of size, gain, and radiation patterns. Advanced antenna technologies like MIMO (Multiple Input Multiple Output) are increasingly being integrated to enhance data throughput and connection reliability.

The market growth is driven by surging demand for IoT devices, which grew by 18% year-over-year in 2023, and the rapid adoption of 5G networks requiring advanced RF solutions. Automotive applications represent the fastest-growing segment, projected to account for 28% of market share by 2032 due to increasing vehicle connectivity features. Key industry players including TE Connectivity, Molex, and Amphenol collectively held 45% market share in 2024, with recent product launches focusing on miniaturized antennas for wearable devices and automotive-grade solutions.

MARKET DRIVERS

Proliferation of IoT Devices and Connected Technologies to Accelerate Market Growth

The exponential growth of IoT devices across industries is driving unprecedented demand for WiFi Bluetooth radio frequency antennas. With over 40 billion active IoT connections expected by 2025, the need for reliable wireless connectivity solutions has never been higher. These antennas serve as critical components in smart home ecosystems, industrial automation systems, and wearable technologies, enabling seamless data transmission across networks. The automotive sector’s rapid adoption of vehicle-to-everything (V2X) communication technologies further amplifies this demand, with modern vehicles requiring multiple antennas for navigation, entertainment, and safety systems.

Advancements in 5G Infrastructure Deployment to Fuel Antenna Innovation

Global 5G network expansion is creating substantial opportunities for advanced antenna technologies. Current 5G implementations require sophisticated antenna designs capable of supporting higher frequency bands while maintaining efficient power consumption. The transition to millimeter wave (mmWave) frequencies in particular demands innovative antenna solutions that can overcome propagation challenges. Manufacturers are responding with compact, high-performance antennas featuring beamforming capabilities and improved signal-to-noise ratios. For instance, recent development cycles have seen a 35% improvement in antenna efficiency for mmWave applications compared to previous generations.

Increasing Consumer Demand for High-Speed Wireless Connectivity to Drive Adoption

Consumer expectations for uninterrupted, high-bandwidth connectivity continue to shape antenna technology development. The average household now contains more than 10 connected devices, each requiring robust wireless performance. This trend has led antenna manufacturers to focus on multi-band solutions that can simultaneously support WiFi 6/6E, Bluetooth 5.x, and emerging standards. Streaming applications alone account for over 65% of internet traffic during peak hours, creating persistent demand for antennas with superior range and interference mitigation capabilities. Recent product launches demonstrate significant improvements in throughput, with some consumer-grade antennas now supporting concurrent data rates exceeding 3 Gbps.

MARKET RESTRAINTS

Signal Interference and Spectrum Congestion Challenges Impacting Performance

The growing density of wireless devices creates significant challenges for maintaining signal integrity. In urban environments, spectrum congestion has reached critical levels, with some frequency bands exhibiting interference levels that degrade antenna performance by up to 40%. This is particularly problematic for Bluetooth Low Energy (BLE) applications in crowded settings like retail stores or smart offices. Device manufacturers must implement increasingly sophisticated filtering techniques and adaptive algorithms to counteract interference, which adds complexity and cost to antenna systems.

Miniaturization Constraints Limiting Design Options

The relentless push for smaller form factors in consumer electronics presents substantial engineering challenges for antenna designers. As device footprints shrink, antennas must maintain performance while occupying less than half the space they required five years ago. This miniaturization often comes at the expense of radiation efficiency, with some compact antennas experiencing up to 30% reduction in effective range compared to their larger counterparts. The integration of multiple wireless protocols into single-chip solutions further exacerbates these constraints, requiring careful optimization of PCB layout and component placement.

MARKET CHALLENGES

Complex Certification Processes Delaying Time-to-Market

Navigating global regulatory requirements remains a persistent challenge for antenna manufacturers. Each region maintains distinct certification protocols for wireless devices, with testing procedures often taking six months or longer to complete. The introduction of new frequency bands for 5G and WiFi 6E has added further complexity, requiring extensive retesting for compliance with evolving standards. These delays can significantly impact product launch timelines and increase development costs, particularly for small and medium-sized enterprises.

Supply Chain Vulnerabilities Affecting Component Availability

The antenna industry faces ongoing supply chain disruptions affecting critical materials and components. Specialty substrates and high-frequency laminates essential for advanced antenna designs have experienced lead time extensions of up to 12 months in some cases. Semiconductor shortages have also impacted integrated RF front-end modules, creating production bottlenecks. These constraints have compelled manufacturers to redesign products around available components, sometimes compromising performance specifications to maintain shipment schedules.

MARKET OPPORTUNITIES

Emergence of Smart Cities and Infrastructure Creates New Demand Channels

The global smart city initiative represents a substantial growth opportunity for antenna manufacturers. Municipal deployments of IoT sensors, traffic management systems, and public safety networks require robust wireless infrastructure. These applications often necessitate ruggedized antenna solutions capable of withstanding harsh environmental conditions while maintaining reliable connectivity across diverse urban landscapes. Recent pilot programs have demonstrated that smart city networks can reduce operational costs by up to 30% while improving service delivery, indicating strong potential for continued investment in these technologies.

Advancements in Material Science Enabling Next-Generation Antennas

Breakthroughs in metamaterials and flexible electronics are opening new possibilities for antenna design. Researchers have developed composite materials that exhibit negative refraction indexes, allowing for unprecedented control over electromagnetic wave propagation. These innovations support the development of conformal antennas that can be integrated into clothing, flexible displays, and curved surfaces without sacrificing performance. Early prototypes demonstrate 40% wider bandwidth and improved gain characteristics compared to conventional designs, suggesting significant potential for commercialization in coming years.

Integration of AI for Adaptive Antenna Systems Creates Competitive Advantage

The incorporation of machine learning algorithms into antenna control systems represents a transformative opportunity for the industry. Modern adaptive antenna arrays can now employ real-time pattern optimization based on environmental conditions and usage patterns. These intelligent systems demonstrate remarkable improvements in energy efficiency, with some implementations reducing power consumption by up to 60% during low-demand periods. As edge computing capabilities expand, the ability to locally process signal data and optimize radiation parameters will become an increasingly valuable differentiator in competitive markets.

WI-FI BLUETOOTH RADIO FREQUENCY ANTENNA MARKET TRENDS

5G and IoT Expansion Driving Antenna Innovation

The proliferation of 5G networks and IoT devices is significantly accelerating demand for advanced Wi-Fi and Bluetooth RF antennas. With over 1.4 billion 5G connections globally as of recent data, manufacturers are developing compact, high-performance antennas that support wider frequency ranges (2.4GHz-6GHz) and MIMO (Multiple Input Multiple Output) configurations. The automotive sector particularly demonstrates growth, where premium vehicles now incorporate 15+ antennas for connected features. Emerging antenna-on-chip (AoC) and antenna-in-package (AiP) technologies are enabling smaller form factors while maintaining signal integrity in space-constrained applications like wearables and smart home devices.

Other Trends

Miniaturization and Integration Challenges

As consumer electronics shrink, antenna designers face mounting pressure to deliver sub-6mm solutions without sacrificing performance. While chip antennas dominate smartphone applications (85% market penetration in flagship devices), hybrid designs combining ceramic and PCB antennas are gaining traction for industrial IoT applications requiring ruggedness. The trade-off between size and efficiency remains critical – recent tests show compact antennas can experience 15-20% efficiency drops compared to traditional external antennas. Manufacturers are countering this through advanced simulation tools and metamaterial coatings that enhance radiation patterns.

Automotive Connectivity Demand Surge

The automotive sector is emerging as a key growth vertical, with connected car antennas expected to comprise 30% of the market by 2026. Modern vehicle architectures require antennas supporting Wi-Fi 6, Bluetooth 5.2, C-V2X, and satellite communications simultaneously. This complexity drives adoption of multi-band, multi-protocol antenna arrays, particularly for electric vehicles where traditional shark-fin housings interfere with aerodynamics. Recent developments include embedded glass antennas and conformal designs molded into body panels, yielding 40% space savings while maintaining 5dB gain improvements over conventional whip antennas.

WiFi Bluetooth Radio Frequency Antenna Market – Competitive Landscape

Key Industry Players

Innovation and Market Expansion Drive Fierce Competition Among Antenna Manufacturers

The global WiFi Bluetooth Radio Frequency Antenna market is characterized by moderate consolidation, with major players competing alongside emerging manufacturers. Leading companies are focusing on miniaturization, multi-band compatibility, and improved signal efficiency to maintain their competitive edge. The market is witnessing accelerated growth due to increasing demand across automotive, consumer electronics, and IoT applications.

TE Connectivity and Amphenol currently dominate the global antenna market, collectively holding approximately 30% market share in 2024. Their dominance stems from extensive product portfolios spanning internal and external antennas, along with strong distribution networks across North America and Europe. Both companies have recently introduced 5G-compatible antennas, addressing the growing need for high-speed connectivity in smart devices.

Molex and Laird Connectivity are emerging as significant competitors, particularly in the automotive electronics sector. These companies are investing heavily in low-profile antenna designs that can be integrated seamlessly into modern vehicle architectures. Their focus on automotive-grade reliability and extended temperature range performance gives them an advantage in this demanding application segment.

The competitive landscape is further enriched by specialized manufacturers like Taoglas and C&T RF Antennas, who are carving niches in high-performance industrial applications. These companies differentiate themselves through proprietary technologies such as beamforming antennas and advanced impedance matching techniques.

Strategic Developments Shaping the Market

Recent industry movements highlight aggressive growth strategies among key players:

Abracon expanded its antenna solutions portfolio through acquisitions in 2024

Pulse Electronics partnered with major smartphone OEMs for customized antenna solutions

INPAQ Technology launched a new line of ultra-wideband (UWB) antennas for precise positioning applications

These strategic initiatives demonstrate how companies are adapting to meet the evolving connectivity requirements of modern electronic devices, particularly in automotive telematics and industrial IoT sectors.

List of Leading WiFi Bluetooth RF Antenna Manufacturers

TE Connectivity (Switzerland)

Amphenol (U.S.)

Molex (U.S.)

Laird Connectivity (U.K.)

Abracon (U.S.)

Pulse Electronics (U.S.)

Taoglas (Ireland)

C&T RF Antennas (China)

Eteily Technologies (India)

INPAQ Technology (Taiwan)

Linx Technologies (U.S.)

MARS Antennas (U.S.)

Wieson Technologies (Taiwan)

The market remains dynamic as manufacturers balance the need for cost-effective solutions with demands for higher performance across increasingly congested RF spectrums. Companies that can combine innovative engineering with scalable manufacturing are best positioned to capitalize on the projected market growth through 2032.

WiFi Bluetooth Radio Frequency Antenna Market: Segment Analysis

By Type

Internal Antennas Segment Leads the Market Due to Compact Design and Increasing IoT Adoption

The market is segmented based on type into:

Internal Antennas

Subtypes: PCB trace antennas, chip antennas, and others

External Antennas

Subtypes: Dipole, monopole, patch, and others

By Application

Consumer Electronics Dominates Due to Proliferation of Smart Devices

The market is segmented based on application into:

Automobile Electronics

Aerospace and Defense

Consumer Electronics

Others

By Frequency Band

2.4GHz Segment Holds Significant Share Owing to WiFi and Bluetooth Compatibility

The market is segmented based on frequency band into:

2.4GHz

5GHz

Sub-1GHz

Others

Regional Analysis: WiFi Bluetooth Radio Frequency Antenna Market

North America North America remains a dominant region in the WiFi Bluetooth Radio Frequency Antenna market, driven by rapid advancements in IoT and smart device adoption. The U.S. leads in innovation, with key players like Amphenol and TE Connectivity investing heavily in R&D for compact, high-performance antennas. The automotive sector, particularly electric vehicle production, is a major growth driver due to increasing demand for connected infotainment systems. However, stringent FCC regulations on spectrum allocation and signal interference pose challenges for manufacturers. The region is shifting toward internal antennas for sleek consumer electronics designs, with companies prioritizing low-power, high-efficiency solutions.

Europe Europe’s market thrives on strict compliance with CE and RED (Radio Equipment Directive) standards, pushing manufacturers toward energy-efficient designs. Germany and the U.K. are key contributors, focusing on industrial IoT and 5G-ready antenna solutions. The adoption of WiFi 6/6E and Bluetooth 5.2/5.3 technologies in smart homes and wearables is accelerating demand. However, supply chain disruptions and material shortages have impacted production timelines. Despite this, sustainability initiatives are shaping product development, with recyclable materials gaining traction. The aerospace sector also presents growth opportunities, particularly for ruggedized antennas in defense applications.

Asia-Pacific Asia-Pacific is the fastest-growing market, fueled by China’s massive electronics manufacturing ecosystem and India’s expanding telecom infrastructure. China accounts for over 40% of global antenna production, serving both domestic and international markets. The region favors cost-effective external antennas for industrial applications, though internal variants are gaining ground in smartphones and IoT devices. Japan and South Korea lead in high-frequency antenna innovations, particularly for 5G small cells. Challenges include price sensitivity and intellectual property concerns, but government initiatives like China’s “Digital Silk Road” are boosting long-term prospects. Southeast Asian nations are emerging as alternative manufacturing hubs due to lower labor costs.

South America The South American market shows moderate growth, with Brazil being the primary adopter of WiFi Bluetooth antennas for automotive and agricultural IoT applications. Economic instability and currency fluctuations hinder large-scale investments, leading to reliance on imported components. Nevertheless, smart city projects in urban centers are driving demand for public WiFi antennas. Local manufacturers face competition from Chinese suppliers offering budget solutions, though quality concerns persist. Regulatory frameworks are less stringent compared to North America or Europe, allowing faster product launches but risking interoperability issues.

Middle East & Africa This region exhibits untapped potential, with the UAE and Saudi Arabia spearheading smart infrastructure projects requiring advanced RF antennas. The oil & gas sector utilizes rugged antennas for remote monitoring, while urban centers deploy WiFi 6 systems in transportation hubs. Africa’s growth is hampered by limited technical expertise and infrastructure gaps, though mobile network expansions present opportunities. Cost remains a critical factor, with many projects opting for refurbished or lower-tier antenna solutions. Political instability in some areas creates supply chain risks, but increasing foreign investments in telecom and renewable energy projects indicate future demand growth.

Report Scope

This market research report provides a comprehensive analysis of the global and regional WiFi Bluetooth Radio Frequency Antenna markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.5 billion by 2032, growing at a CAGR of 9.8%.

Segmentation Analysis: Detailed breakdown by product type (Internal Antennas, External Antennas), application (Automobile Electronics, Aerospace & Defense, Consumer Electronics), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America (30% market share), Asia-Pacific (fastest growing at 12.1% CAGR), Europe, Latin America, and Middle East & Africa.

Competitive Landscape: Profiles of 13 key players including Abracon, Amphenol, TE Connectivity, and Molex, covering their market share (top 5 control 45% revenue), product portfolios, and strategic developments.

Technology Trends: Analysis of 5G integration, IoT antenna designs, miniaturization trends, and emerging materials like liquid crystal polymer (LCP) substrates.

Market Drivers & Restraints: Evaluation of factors including 5G rollout (86% of telecom operators investing), smart home adoption (2.2 billion devices in 2024), and supply chain challenges for rare earth materials.

Stakeholder Analysis: Strategic insights for OEMs, component suppliers, and investors regarding the USD 78 billion IoT antenna opportunity and automotive connectivity trends.

Related Reports:

https://semiconductorblogs21.blogspot.com/2025/06/global-pecvd-equipment-market-size.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-embedded-sbc-market-trends-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-encoder-chips-market-driving.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-bluetooth-audio-chips-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/semiconductor-ip-blocks-market-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-dc-power-supply-for.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-high-voltage-power-supply-for.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-industrial-sun-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-consumer-grade-contact-image.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-non-residential-occupancy.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-standalone-digital-signage.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/12-inch-silicon-wafers-market-global-12.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-12-inch-semiconductor-silicon.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-extreme-ultraviolet-lithography.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-industrial-touchscreen-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-distributed-fiber-optic-sensor.html

0 notes

Text

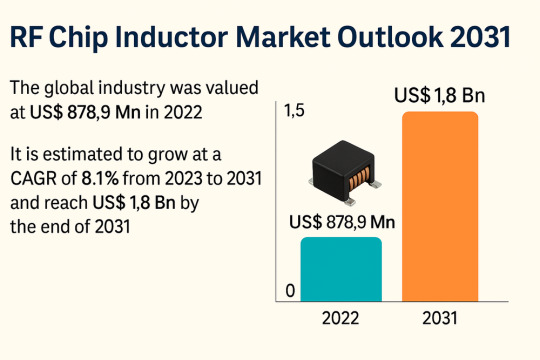

Robust Growth Forecast for Global RF Chip Inductor Market Through 2031

The global RF chip inductor market, valued at US$ 878.9 Mn in 2022, is projected to reach US$ 1.8 Bn by 2031, expanding at a CAGR of 8.1% from 2023 to 2031. Driven by rapid advancements in wireless communication, miniaturization of electronic devices, and increased integration of RF components in automobiles, the market is poised for robust growth throughout the forecast period.

Market Overview: RF chip inductors are integral components in wireless systems, designed for use in compact electronic circuits to manage radio frequency (RF) signals. These inductors are commonly integrated into System-on-Chip (SoC) and Integrated Circuit (IC) applications across smartphones, laptops, automotive electronics, and Internet of Things (IoT) devices.

Ceramic and ferrite types dominate the RF chip inductor market, with ceramic variants gaining significant traction due to their high-Q factors and low losses.

Market Drivers & Trends

1. Proliferation of Wireless Devices The surge in global demand for smartphones, tablets, smartwatches, and wireless earphones has led to a parallel rise in demand for RF chip inductors. These components are essential for wireless signal tuning and filtering, enabling efficient data transmission.

2. Automotive Electronics Boom Modern vehicles are evolving into connected hubs with built-in infotainment, GPS, keyless entry, and telematics systems. RF chip inductors are critical to these systems, especially in enabling secure and efficient data communication. India’s vehicle exports exceeding 5.6 million units in 2022 underscore the automotive sector's expanding role.

3. Government Investments Strategic investments in telecommunications infrastructure, like India's US$ 611.1 Mn for BharatNet, bolster the deployment of RF components, accelerating market growth.

Latest Market Trends

Miniaturization and Material Innovation Key industry players are focused on innovating smaller form factor inductors that can perform at higher frequencies. Advanced material research is helping improve signal integrity and reduce power consumption.

Rise of Wearables and IoT RF chip inductors are becoming central to the performance of wearable technologies, enabling seamless Bluetooth and Wi-Fi connectivity.

Increased Demand for Ceramic Inductors Ceramic chip inductors, which held a 54.3% share in 2022, offer superior performance, particularly in high-frequency environments. This segment is expected to grow at 8.4% CAGR during the forecast period.

Key Players and Industry Leaders

The global RF chip inductor industry is moderately consolidated with major players driving technological advancements through R&D and strategic partnerships. Leading companies include:

Murata Manufacturing Co., Ltd.

Coilcraft Inc.

KYOCERA AVX Components Corporation

Vishay Intertechnology, Inc.

Johanson Technology Incorporated

Würth Elektronik GmbH & Co. KG

Viking Tech Corporation

These companies are investing in ceramic and multilayer inductor technologies, launching ultra-miniature and high-performance products.

Access important conclusions and data points from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85752

Recent Developments

Gowanda Electronics (Feb 2022) launched the SMP0603 ceramic chip inductors, targeting power and RF applications in automotive and industrial systems.

KYOCERA AVX (Mar 2021) introduced the LCCI series multilayer ceramic chip inductors, designed for compact mobile and wireless systems including RFID, WLAN, and EMI suppression in high-frequency circuits.

Market Opportunities

Emerging Markets Rapid urbanization and rising digital connectivity in developing countries, particularly in Asia Pacific and Latin America, present significant growth potential.

5G Rollout The global deployment of 5G networks will further increase the demand for high-performance RF chip inductors, especially those that can handle ultra-high frequencies.

Electric and Autonomous Vehicles The transition toward autonomous and electric vehicles is expected to significantly boost demand for compact and robust RF components, opening lucrative avenues for market expansion.

Future Outlook

The RF chip inductor market is projected to continue its upward trajectory due to:

Expansion in consumer electronics production

Innovation in inductor materials and manufacturing

Strategic alliances and mergers among major players

Growing application in healthcare and industrial IoT

By 2031, the market is expected to nearly double in size, creating opportunities across the value chain, from component design and production to system integration.

Market Segmentation

By Type

Ceramic

Ferrite

By Structure Type

Film

Wire Wound

Multilayer

Air Core

By Inductance Range

Up to 100 nH

100–200 nH

200–400 nH

400–800 nH

800 nH–3.3 µH

Above 3.3 µH

By Application

Infotainment Systems

Smartphones

Portable Electronics

Broadband

Computer Peripherals

RFIDs

RF Transceivers

Others (Medical Imaging, PCS Modules)

By End-use Industry

Automotive & Transportation

Aerospace & Defense

Consumer Electronics

IT & Telecommunications

Industrial

Others (Healthcare, Energy, etc.)

Regional Insights

Asia Pacific leads the global RF chip inductor market, holding 40.8% market share in 2022. It is projected to maintain dominance due to:

High concentration of consumer electronics manufacturers

Growth in automotive production and export

Expansion of 5G infrastructure, especially in China, Japan, and South Korea

North America accounted for 27.6% market share in 2022 and is likely to experience steady growth due to advanced R&D capabilities and adoption of high-frequency RF applications in aerospace and defense.

Europe is also a promising region, especially with increasing focus on electric mobility and connected car infrastructure.

Why Buy This Report?

Comprehensive Market Coverage: Includes quantitative and qualitative analysis from 2017 to 2031.

In-depth Segmentation: Extensive breakdown by type, application, structure, and region.

Company Profiles: Detailed insights into major players and their strategic developments.

Industry Analysis: Includes Porter’s Five Forces, value chain analysis, and market attractiveness.

Actionable Insights: Identify key opportunities, regional hotspots, and emerging applications.

Explore Latest Research Reports by Transparency Market Research: Semiconductor Etching Equipment Market: https://www.transparencymarketresearch.com/semiconductor-etching-equipment-market.html

Linear Motor Market: https://www.transparencymarketresearch.com/linear-motor-market.html

Wafer Handling Robots Market: https://www.transparencymarketresearch.com/wafer-handling-robots-market.html

Time of Flight Sensor Market: https://www.transparencymarketresearch.com/time-of-flight-sensor-market.html

0 notes

Text

Strategies for Reducing the Amount of EMFs in Your Home

In the last few years, electromagnetic frequencies (EMFs) have become a concern for many in a world where EMFs are integral to communications and energy. EMF refers to the radiation emitted every time you use an electronic device, whether a computer, a microwave, a cell phone, or power your home with electricity. In high amounts, EMFs can affect your health. However, you can reduce EMF levels in your home in several ways.

To begin with, there are four types of EMFs: magnetic fields, electric fields, radio frequencies (RFs), and finally, so-called “dirty electricity”.

Reducing the amount of EMFs in your home starts with purchasing one or more EMF meters. They give you readings of magnetic fields, electric fields, micro/radio waves and dirty electricity where you sit, sleep and stand. These meters can tell you the level of magnetic fields emitted from your appliances and devices and the level of RF from your cell phone, tablet or laptop and from nearby cell phone towers in the neighborhood.

We protect against magnetic field EMFs by choosing houses away from power lines that generate magnetic fields into the yard and house (however not all power lines emit magnetic fields that reach the house). We can hire a building biologist to work with an electrician to trace and fix wiring errors in electrical circuits. Go to https://buildingbiologyinstitute.org/find-an-expert/ to find a building biologist near you. A plumber can insert a dielectric union into your incoming metal water pipe from the city water main under the street if the incoming pipe carries electric current as that pipe runs under your floor, which is another source of magnetic fields.

You can also reduce magnetic field EMF exposure by sitting, sleeping and standing more than six feet from a breaker panel or refrigerator and replacing electricity-operated appliances with battery-operated ones, such as the clock next to your bed.

Reducing electric field EMF levels in your home can be as simple as turning off circuit breakers that power circuits to your bedrooms at night. A building biologist can determine which circuits need to be shut off. An electrician can install a U.L.-approved remote circuit cut off kit next to your panel so that you can remotely shut off circuits at night when you sleep from your bedroom without having to go to the breaker panel.

Finally, to reduce daytime electric field EMFs, make sure your computer has a grounded power supply with a three-pronged plug, especially laptops. Read the Electric Field section of Safer Use of Computers for details at https://createhealthyhomes.com/education/safer-use-of-computers/.

Tamping down technology use can reduce radiofrequency EMFs. Experts recommend reducing use of cell phones when away from home, increasing the distance between the phone and your head and body, and favoring hardwired connections when at home, in the office and at school (then put the device in Airplane Mode with WiFi and Bluetooth “Off”). Hardwire your laptop’s connection to the Internet with a grounded, shielded Ethernet cable. See Safer Use of Computers (https://createhealthyhomes.com/education/safer-use-of-computers/) and Safer Use of Cell Phones (https://createhealthyhomes.com/education/safer-use-of-cell-phones/).

Another suggestion is to stop using Bluetooth headphones, which emit high radio frequency levels. Consider alternatives to Bluetooth headsets, such as wired or air tube headphones, which emit 99 percent less RF than traditional headphones. Air tube headphones produce sound through hollow tubes, which bring sound from the device to your ear without carrying wireless RF radiation that is transmitted from the phone’s antenna up the wire all the way to your head.

We recommend that you avoid sleeping next to your cell phone. Experts state that sleeping beside your phone or with it under your pillow is the worst thing you can do to reduce radio frequency exposure. If you use your cell phone alarm to wake up, experts recommend putting your cell phone into Airplane Mode when sleeping (making sure WiFi and Bluetooth are “Off”) or switching altogether to a battery-operated alarm clock and charging your cell phone in another room.

Dirty electricity, the fourth type of EMF, radiates into rooms from high-frequency voltage spikes carried on electrical circuits and plugged-in cords. The sources of theses spikes of dirty power can be mini-split air conditioning units, energy-efficient furnaces, smart home devices, and other appliances that generate electrical interference that is then carried on and radiated from circuits and cords in your house and in your neighbor’s houses. Other seemingly innocuous sources of dirty power are LED and fluorescent lights (including those with dimmers), solar panel inverters, smart electric meters, variable speed motors in appliances, switch-mode electronic power supplies, cell phone chargers and adapters, and energy-efficient appliances.

Dirty electricity has negative impacts on human health, including depression, fatigue, and cancer. High levels of dirty power can interfere with the nervous, immune, and circulatory systems.

You should consider switching out your compact fluorescent light (CFL) bulbs, which generate high amounts of dirty electricity—high-frequency electricity lights the gas in the bulbs, unlike standard 60 Hertz. While CFLs are more efficient than older incandescent light bulbs, they create electrical spikes on wiring in your house. Instead of using CFLs, consider purchasing incandescent light bulbs where they are available, or LEDs, which now have less dirty electricity than they used to. Look for brands that have low flicker, available from the Flicker Alliance (https://flickeralliance.org/collections/flicker-free-light-bulbs) and the Light Bulb Database (https://optimizeyourbiology.com/light-bulb-database).

Dimmer switches enable you to control how bright the lights are in a room through a knob or slider you can adjust. However, dimmer switches can only work by turning the electricity flow off and on thousands of times each second. The lower the light level, the more the voltage on the line is broken up. Ultimately, this contributes counter-intuitively to higher dirty power generation. Avoid dimmers if you are sensitive to dirty electricity.

Oram Miller is a BBEC, EMRS, Certified Building Biology Environmental Consultant, Electromagnetic Radiation Specialist and Healthy New Building and Remodeling Consultant.

0 notes

Text

CMOS Power Amplifiers Market Drivers Enhancing Efficiency, Integration, and Cost-Effective Wireless Communication Solutions

The CMOS power amplifiers market is witnessing a steady growth trajectory driven by multiple technological, commercial, and application-oriented factors. With wireless communication becoming more pervasive and devices getting smaller and smarter, the demand for compact, energy-efficient, and cost-effective power amplification solutions has risen sharply. CMOS (Complementary Metal-Oxide-Semiconductor) technology, traditionally known for its applications in microprocessors and memory chips, has increasingly found a strong foothold in RF (Radio Frequency) front-end modules, especially power amplifiers.

Rising Demand for Wireless Connectivity

One of the key market drivers is the explosive growth in wireless communication technologies, including 4G, 5G, Wi-Fi 6, and the upcoming 6G. These technologies demand highly efficient and reliable RF components. CMOS power amplifiers provide a suitable balance of performance and affordability, making them ideal for use in smartphones, tablets, IoT devices, wearables, and connected home solutions. As more industries adopt wireless systems for communication, automation, and control, the reliance on CMOS amplifiers continues to expand.

Integration with System-on-Chip (SoC) Solutions

CMOS technology enables easy integration of power amplifiers with digital and analog circuits on the same die, a key driver pushing its adoption in consumer electronics and mobile devices. System-on-Chip integration reduces component count, lowers power consumption, and enables the development of ultra-compact devices. Manufacturers prefer CMOS PAs because of their scalability and compatibility with large-scale semiconductor manufacturing processes, leading to economies of scale and reduced production costs.

Cost Efficiency and Mass Production Benefits

Another important market driver is the cost-effectiveness of CMOS technology. Unlike GaAs (Gallium Arsenide) or other compound semiconductor-based amplifiers, CMOS-based designs are more suitable for high-volume, low-cost manufacturing. This makes them ideal for mass-market applications like smartphones and IoT sensors, where price sensitivity is critical. The use of CMOS also simplifies the supply chain and shortens development cycles, encouraging faster time-to-market for OEMs.

Expansion of IoT and Smart Devices

The rapid growth of the Internet of Things (IoT) ecosystem is a significant catalyst for the CMOS power amplifiers market. Billions of devices—from smart meters and industrial sensors to home automation systems and connected healthcare devices—require efficient RF amplification. CMOS power amplifiers meet the low power, small form factor, and cost demands of such devices, making them an indispensable component in this domain. The proliferation of IoT across both industrial and consumer landscapes ensures long-term demand for CMOS PAs.

Evolution of 5G and Future Networks

As the world shifts toward 5G and beyond, there is an increasing need for high-speed, high-frequency data transmission. Although early 5G implementations relied heavily on GaN and GaAs technologies for their high power capabilities, CMOS-based amplifiers are becoming viable alternatives in specific frequency bands and low-power use cases. The need for a large number of small cell deployments and low-power devices for edge communication is boosting CMOS PA adoption.

Emphasis on Power Efficiency and Battery Life

In mobile and wearable devices, power consumption is a critical factor. CMOS power amplifiers offer better power efficiency at lower costs, helping extend battery life while maintaining signal integrity. As consumers demand longer battery runtime and more powerful features in compact devices, the adoption of CMOS PAs becomes a strategic necessity for device manufacturers.

Growth in Automotive and Industrial Applications

Automotive electronics and industrial automation are increasingly incorporating wireless modules for connectivity and control. From advanced driver-assistance systems (ADAS) to vehicle-to-everything (V2X) communication, these systems benefit from the integration capabilities and robustness of CMOS power amplifiers. Similarly, in industrial automation and remote monitoring, the ability to have low-cost, power-efficient communication modules is pushing the use of CMOS-based RF components.

Government Support and Technological Advancements

Government policies promoting 5G infrastructure, digital transformation, and Industry 4.0 are encouraging the deployment of advanced communication networks that rely on CMOS-based power amplifier technologies. At the same time, advancements in CMOS fabrication and design techniques have helped close the performance gap between CMOS and traditional compound semiconductor technologies. Innovations such as envelope tracking, digital predistortion, and linearization techniques are helping CMOS amplifiers achieve better performance metrics, including linearity and efficiency.

Conclusion

The CMOS power amplifiers market is being driven by a confluence of technological advancements and application needs. As the global economy becomes increasingly digital and wireless-dependent, the demand for scalable, cost-effective, and power-efficient amplification solutions will continue to grow. CMOS power amplifiers, with their integration capability, cost benefits, and evolving performance levels, are well-positioned to address the diverse needs of consumer electronics, automotive, industrial, and telecom sectors.

0 notes

Text

What is copper clad steel wire used for

Copper clad steel wire (CCS) is a composite material that combines the strength of steel with the electrical conductivity of copper. Manufactured by bonding a copper layer onto a steel core through electroplating, cladding, or other metallurgical processes, CCS offers a cost-effective alternative to pure copper conductors while maintaining critical performance characteristics. This article explores the diverse applications of copper clad steel wire across industries, highlighting its role in modern technology and infrastructure.

Telecommunications and Cable Industries CCS is widely used in telecommunications, particularly in coaxial cables for cable TV (CATV) subscriber lines and broadband networks. Its ability to leverage the "skin effect"—a phenomenon where high-frequency signals travel primarily along the conductor's surface—allows CCS to match the conductivity of pure copper at frequencies above 5 MHz. This makes it ideal for inner conductors in coaxial cables, where copper ensures signal integrity while steel provides mechanical strength. For instance, Shanghai BISCO International Corporation’s CCS products, compliant with standards like ASTM B227 and GB 12269, are deployed in CATV systems and local area networks (LANs), offering durability and cost efficiency.

Electrical Power Transmission and Grounding In the power sector, CCS serves as a reliable conductor for overhead transmission lines, grounding systems, and railway electrification. Its high tensile strength, derived from the steel core, enables it to withstand mechanical stress in long-span installations. Meanwhile, the copper layer ensures low electrical resistance, critical for efficient power transfer. CCS is also used in grounding rods for electrical installations, where its corrosion resistance—enhanced by surface treatments like tin or silver plating—extends service life. For example, Jiangsu Reliable Industry Co., Ltd. produces CCS wires with conductivities ranging from 21% to 40% IACS, suitable for power transmission and grounding applications.

Electronics and Component Manufacturing CCS wire is a preferred material for electronic components, such as connectors, leads, and printed circuit board (PCB) traces. The copper layer provides solderability and electrical conductivity, while the steel core adds structural rigidity. This combination is valuable in high-density electronics, where space constraints demand materials that balance performance and mechanical integrity. Additionally, CCS is used in RF (radio frequency) cables for high-frequency applications, such as antennas and wireless communication systems, where its skin-effect properties ensure minimal signal loss.

Railway and Transportation Infrastructure The transportation sector relies on CCS for catenary wires in electrified railways and tram systems. Here, the material’s strength-to-weight ratio is crucial for supporting overhead lines over long distances. For example, Japan’s Shinkansen bullet trains use CCS catenary wires to ensure reliable power delivery at high speeds. CCS is also employed in grounding systems for railway infrastructure, protecting against lightning strikes and electrical faults.

Defense and Aerospace Applications In defense and aerospace, CCS is used for lightweight, high-strength wiring in aircraft, satellites, and military equipment. Its resistance to vibration and extreme temperatures makes it suitable for avionics systems, where reliability is non-negotiable. Additionally, CCS is used in shielded cables to protect sensitive electronics from electromagnetic interference (EMI).

Renewable Energy and High-Temperature Systems CCS is gaining traction in renewable energy projects, such as solar farms and wind turbines, where its durability and conductivity are valued in harsh environments. It is also used in high-temperature applications, such as industrial furnaces and heating elements, where copper’s thermal conductivity and steel’s heat resistance are synergistic.

Conclusion Copper clad steel wire (CCS) has emerged as a versatile material with applications spanning telecommunications, power transmission, electronics, transportation, defense, and renewable energy. Its unique combination of steel’s mechanical strength and copper’s electrical conductivity makes it indispensable in industries where performance, cost, and durability are critical. As technology advances, CCS continues to evolve, with new specifications (e.g., ASTM’s proposed 21–70% IACS standards) expanding its potential in emerging fields. Whether in high-frequency cables, railway catenaries, or aerospace wiring, CCS remains a testament to the power of composite materials in modern engineering. Its adaptability and reliability ensure that copper clad steel wire will remain a cornerstone of infrastructure and technology for years to come.

0 notes

Text

Antenna in Package AiP Market Opportunities Rising with Expansion of Millimeter Wave Technology Globally

The Antenna in Package (AiP) market is gaining significant traction as wireless communication technologies become increasingly integrated into compact, high-performance electronic devices. AiP technology incorporates antennas directly into semiconductor packages, enabling advanced radio frequency (RF) performance while saving space. This innovation is particularly relevant in 5G, millimeter-wave (mmWave), automotive radar, satellite communications, and IoT applications.

Market Drivers

One of the primary drivers of the AiP market is the global rollout of 5G technology, which operates at higher frequencies such as mmWave. These frequencies require advanced antenna solutions capable of handling high data rates and low latency. Traditional printed circuit board (PCB) antennas often fall short in terms of integration and performance. AiP offers a more efficient alternative by reducing interconnect losses and supporting beamforming technologies critical for 5G.

Another major factor is the increasing miniaturization of consumer electronics. Smartphones, wearables, and IoT devices demand compact components that deliver excellent performance. AiP technology meets this requirement by integrating the antenna and RF front-end into a single compact module, freeing up space and improving system-level efficiency.

Technological Advancements

Recent advancements in substrate materials, system-in-package (SiP) technologies, and 3D packaging are making AiP solutions more cost-effective and scalable. Low-temperature co-fired ceramic (LTCC) and organic substrates have enabled better thermal and electrical performance. Integration of multiple functions such as filters, power amplifiers, and transceivers within the package has allowed manufacturers to create multi-functional modules tailored for specific end-uses.

In addition, the evolution of advanced simulation tools and design automation has shortened development cycles and reduced costs, making AiP more accessible to a broader range of industries. These advancements have facilitated faster prototyping and more reliable testing environments.

Key Market Segments

The AiP market can be segmented based on frequency band, end-user application, and geography.

By frequency, the market includes sub-6 GHz and mmWave segments, with mmWave seeing higher growth due to its necessity in 5G and automotive radar applications.

By application, the market is divided into consumer electronics, automotive, telecommunications, aerospace and defense, and industrial IoT.

Geographically, North America and Asia-Pacific dominate the AiP landscape, thanks to the presence of major semiconductor companies and 5G infrastructure deployment.

Regional Insights

Asia-Pacific leads the AiP market due to robust electronics manufacturing ecosystems in countries like China, South Korea, Taiwan, and Japan. Government initiatives to boost 5G and smart city projects further support AiP growth in the region. North America, especially the United States, sees significant demand from telecom providers, defense contractors, and autonomous vehicle manufacturers. Europe is also emerging as a key region, driven by automotive and industrial automation applications.

Competitive Landscape

The AiP market is highly competitive, with key players including Qualcomm, ASE Group, Amkor Technology, Murata Manufacturing, TSMC, and MediaTek. These companies are investing in research and development to improve integration, reduce power consumption, and enhance RF performance. Collaborations, joint ventures, and strategic acquisitions are common strategies to gain market share and accelerate product development.

Startups and mid-sized players are also entering the space with niche AiP solutions for IoT and wearable devices, contributing to market dynamism and innovation.

Challenges and Opportunities

Despite its promise, AiP adoption faces several challenges. High design complexity, thermal management issues, and initial manufacturing costs are significant barriers. Additionally, maintaining signal integrity in densely packed modules remains a technical hurdle.

However, opportunities abound. As mmWave adoption expands and edge computing grows in importance, AiP is poised to play a pivotal role in enabling low-latency, high-speed communication across various devices and systems. The trend toward smart cities, connected vehicles, and AR/VR applications also offers long-term growth potential.

Future Outlook

The AiP market is expected to grow at a CAGR exceeding 15% over the next five years, driven by surging demand across multiple industries. Technological advancements, cost optimization, and expanding 5G infrastructure will be key enablers. As device manufacturers strive to balance performance, size, and power efficiency, AiP is likely to become a standard in RF design and packaging.

#AntennaInPackage#AiPMarket#5GTechnology#MillimeterWave#WirelessCommunication#IoTDevices#RFTechnology

0 notes

Text

B.Tech in Electronics and Communication Engineering: A Comprehensive Guide for Aspiring Engineers

Are you passionate about technology, communication systems, and electronics? A Bachelor of Technology (B.Tech) in Electronics and Communication Engineering (ECE) offers a dynamic and future-ready career path. This program integrates core principles of electronics with modern communication technologies, preparing students for diverse roles in today's tech-driven world.

Understanding Electronics and Communication Engineering

Electronics and Communication Engineering is a discipline that combines electronic engineering with computer science and information technology. It focuses on designing, developing, and testing electronic circuits, devices, and communication equipment like transmitters, receivers, and integrated circuits. This field is pivotal in the advancement of technologies such as mobile phones, satellite systems, and the Internet of Things (IoT).

Course Structure and Curriculum

The B.Tech ECE program typically spans four years, divided into eight semesters. The curriculum is designed to provide a strong foundation in both theoretical and practical aspects of electronics and communication.

Core Subjects:

Digital Electronics

Analog Circuits

Signals and Systems

Electromagnetic Field Theory

Microprocessors and Microcontrollers

Communication Systems

VLSI Design

Embedded Systems

Wireless Communication

Optical Communication

Laboratory Work:

Hands-on experience is a crucial part of the program, with labs focusing on circuit design, signal processing, microprocessor programming, and communication systems.

Electives and Specializations:

Students can choose electives in areas like: